Imagine that you want to buy a new car, but you don't have enough money to do it.

Your neighbour wants to borrow $100 from you. You don't know this person very well. What will you do?

You borrowed your friend's mobile phone. You dropped it, and the phone screen cracked. The phone still works. Your friend said, "Don't worry about it", but you still feel bad. However, you don't have extra $150 to replace the phone. What will you do?

Your work is far from your home. You take two buses and a train to get to work. Your partner's parents rarely use their car. They want to lend it to you.Your partner wants you to use it. What will you do?

You've lent your colleague $100. The colleague promised to pay you back two months ago. You have reminded them about it twice in the past three weeks. What will you do?

Credit Conditions The history of Grameen Bank Clients

Worldwide recognition The bank of the poor

__________________

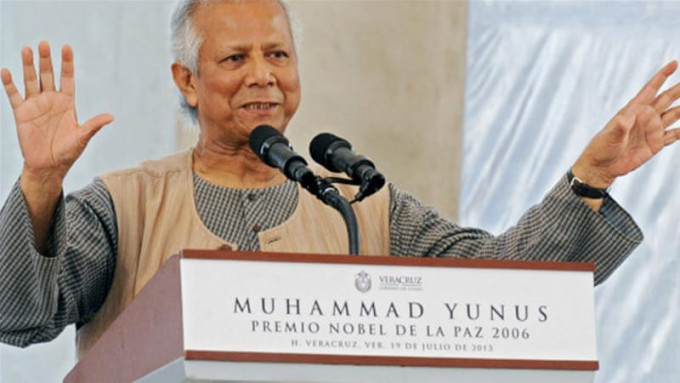

In 1976, Muhammad Yunus, a Bangladeshi professor of economics, set up Grameen Bank. This started a new era of banking — microcredit. Micro credit organisations lend small sums of money — usually no more than $100 — to very poor people who can't get money from regular banks.

__________________

People who borrow money from such organisations usually live in the countryside. Most of them, about 96%, are women. They use credit to build a start-up and make money for their families.

__________________

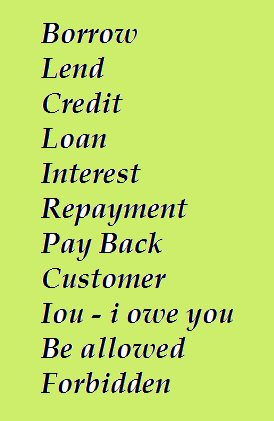

Customers have to make repayments every week for twelve months. They payabout 16% interest a year. Statistics show that 98% of the customers pay back their loans. People who want to take out a loan don't have to give guarantees in the form of capitals, but they are obliged to make groups of five people, calledloan circles. People of the circle meet regularly and discuss their ideas: they demonstrate that their project is valid and reliable. If someone in the group doesn't make repayments, all people in the group are forbidden to get credit in the future. However, if everyone makes their repayments, they are allowed to get bigger loans.

__________________

Microcredit was very popular in Bangladesh: in 2007, Grameen Bank had over seven million customers in nearly eighty thousand villages. Unfortunately, in 2012 the government of Bangladesh nationalised the banking house, marking the end of an era. But microcredit has become a system beyond the boundaries of India and Bangladesh. There are now thousands other microcredit organisations around the world, including Europe and the United States.

__________________

Professor Yunus was awarded the Nobel Peace Prize in 2006.